Second-level thinking is a deep and complex approach to decision-making that goes beyond superficial analysis. Second-level thinkers ask probing questions and consider multiple perspectives to gain a more comprehensive understanding of a situation. They examine a range of potential outcomes, assess probabilities and compare their views to the consensus. They uncover insights that others may overlook, allowing them to make more informed decisions and achieve superior results. By thinking unconventionally and holding well-reasoned, non-consensus views, second-level thinkers position themselves to succeed in investing, business and life.

But how do they do it? Howard Marks is the Chairman and cofounder of Oaktree Capital Management and one of the finest purveyors of second-level thinking (sometimes referred to as second-order thinking). In his book The Most Important Thing: Uncommon Sense for the Thoughtful Investor, Marks explains why second-level thinking is so important and how you can get better at it.

Table of Contents

Discover the 10 common factors intrinsic to developing Executive Mastery.

For founders, C-level executives, investors and other leaders across professional disciplines, Accelerating Executive Mastery >> deep-dives into the metagame of mastery in a complex world.

Beating the market with second-level thinking

On the basis that anyone can invest in an index fund and achieve ‘market returns‘, Marks views the definition of investment success as being the ability to ‘beat the market’. To accomplish that, you need either good luck or superior insight. However, counting on luck isn’t much of a plan, so his advice is to concentrate on insight. And since other investors may be smart, well-informed and highly computerised, you must find an edge that they don’t have.

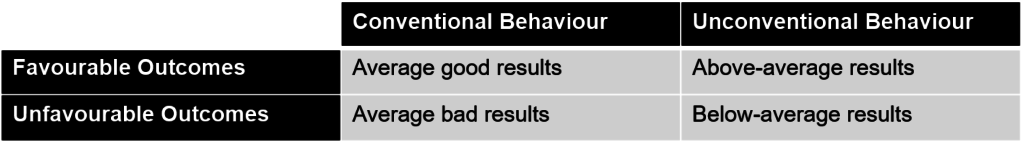

In his September 2006 Memo Dare to be Great, Marks explains ‘unconventionality’ and highlights his matrix for second-level thinking.

Great questions that second-level thinkers ask

In his September 2015 Memo It’s Not Supposed to be Easy, he explains the difference between first and second-level thinkers and gives examples of the sorts of questions a second-level thinker asks.

First-level thinking is simplistic and superficial, and just about everyone can do it. All the first-level thinker needs is an opinion about the future. Second-level thinking is deep, complex and convoluted. The second-level thinker asks:

- What is the range of likely future outcomes?

- Which outcome do I think will occur?

- What’s the probability I’m right?

- What does the consensus think?

- How does my expectation differ from the consensus?

- How does the current price for the asset comport with the consensus view of the future, and with mine?

- Is the consensus psychology that’s incorporated into the price too bullish or bearish?

- What will happen to the asset’s price if the consensus turns out to be right, and what if I’m right?

On being a contrarian and holding non-consensus views

The upshot is simple: to achieve superior investment results, you have to hold non-consensus, contrarian views regarding value, and they have to be right. That’s not easy… The good news is that the prevalence of first level thinkers increases the returns available to second level thinkers. To consistently achieve superior investment returns, you must be one of them.

In business, and life in general, ultimate success often lies in combining unconventional behaviour with favourable outcomes; the need to think and act like a contrarian. After all, logic dictates that if you follow the crowd then you can’t beat the crowd. As Marks says:

You must learn things others don’t, see things differently or do a better job of analyzing them – ideally all three.

I’m Richard Hughes-Jones.

I’m an Executive Coach to founders, CEOs and senior technology leaders in high-growth technology businesses, the investment industry and progressive corporates.

Having often already mastered the technical aspects of their craft, I help my clients navigate the complex adaptive challenges associated with executive-level leadership and growth.

I’m based in London and coach internationally. Find out more about my Executive Coaching services and get in touch if you’d like to explore working together.